Check the Card Payments API reference here.

One of the main functions of PPaaS is to provide a global and comprehensive payment acceptance solution fitting various channels.

In its initial version, PPaaS provides in-store payment acceptance both for card payments and alternative payment methods. PPaaS delivers some omnichannel payment features that ease transaction processing and avoid the need for customers to return to a store to perform some specific transaction types such as to be refunded on their payment card.

PPaaS supports a variety of payment functionalities that include in-store payment and omnichannel services. In-store payment is the payment acceptance from any payment method used by a consumer to buy a product or service from a merchant in a store. Traditional in-store payment methods include debit and credit cards issued by a bank. More recent digital payment methods, so-called Alternative Payment Methods (APM), includes QR-code-based payment methods.

PPaaS offers access to card payments in-store and online. By using PPaaS cloud-based payment API and subscribing to a bank card payment service provided by PPaaS, you will be able to offer bank card services to your merchants. PPaaS bank card payment services use a host-to-host integration between PPaaS and its card payment service providers.

PPaaS clients and their merchants can enable card payment acceptance through two integration models of the payment app on the payment device:

Centralized and unified payment app based on PPaaS Global Reference App (PGRA)- The application developer will use the PGRA thin-client SDK to build his own App. The SDK provides methods allowing the developer to customize the app while benefiting from PGRA’s built-in orchestration of payment flows.

Using their existing Payment App integrating PPaaS On Device Service (PODS) SDK- The developer can build their own UI/UX and design the payment user journey and use PPaaS payment APIs embedded in PODS SDK.

In case the payment app is using an existing terminal to host/payment gateway (PG) connectivity, where card payment services are provided through an external service provider (acquirer or payment gateway), PPaaS reporting APIs can be used to record the payment transaction in PPaaS cloud and make it available to PPaaS clients and their merchants for reporting / access through the merchant portal.

Payment API introduction

The payment API is secured with OAuth 2.0 authentication and authorization. You must proceed with the authentication steps and retrieve your access token as it will be required to integrate with the payment API. Once authentication is completed, you will be able to call the targeted payment API to perform the expected payment operation.

At the time of your subscription to the PPaaS payment services, you will be requested to select and configure the payment methods you wish to support on the PPaaS client portal or using the subscription and configuration API.

Finally, you must ensure that your implementation complies with the relevant Payment Card Industry (PCI) security standards and scheme certification rules, that will be required for your targeted cloud or endpoint integration. Specifically, any sensitive card data such as the Primary Account Number (PAN) must be encrypted.

If you wish to use mutually authenticated Transport Layer Security (TLS), please get in touch with our Support.

Refund and Cancel by Web

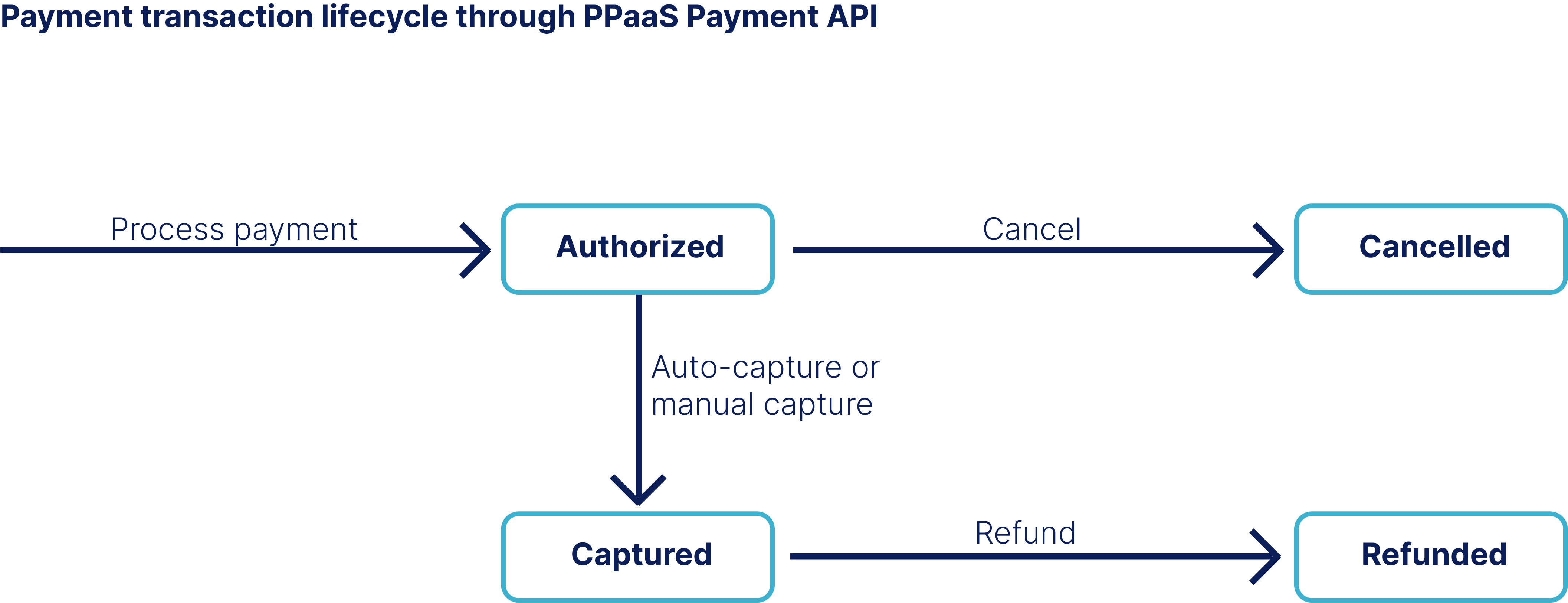

Using PPaaS, you will be able to refund or cancel a transaction through the merchant web portal, without the need of having your customer present in-store (i.e. for a refund for instance).

To benefit from this service, you need to subscribe to the Omnichannel service. Note that not all payment service providers support refunds or cancellations by web. You need to ensure that refund and cancel by the web are enabled in your service provider configuration.